2013 6

Something better to do

Published by MartinVarsavsky.net in General with

In Spain there is tremendous unemployment right now, it has gone up from 7% to 26%, so when I interview there I find a great deal of people looking for something to do. But surprisingly as I have started interviewing in the USA I find that here also everyone seems to be looking for something to do. But this is not because they are not doing anything, but because Americans are always looking for something better to do. The good news about this behavior is that it makes for a more efficient labor market. The bad news is that it also accounts for a lot of unhappiness, both at work and in other realms of life. People here wonder not only if they could have a better job but also if they could be eating at a better restaurant, or hanging out with better people, or having a better boyfriend/girlfriend, or a better spouse, or sadly sometimes even better children. The grass is always greener takes a new dimension in the USA. Americans think that Europeans are laid back but having lived as much time in Europe as in America I can also say that sometimes it is good to be content. The American quest for excellence, for self improvement, for always wanting to do better or having something better to do, can take a high emotional toll. Change is good, improvement is good, competition is good, but being happy with what you have is better.

2012 23

On Why the USA will get over its crisis and Spain may not

Published by MartinVarsavsky.net in Economy with No Comments

I am in Madrid for 8 days. Fon HQ are here, and so is my holding company. I also have great friends, a nice home, and my children who are visiting for Thanksgiving.

I love Spain regardless of the sorry condition the country is in. There is something special, historic, unique about this country. Life here is still good. The crisis has not increased crime or made life in any way uncomfortable for those who still have their jobs. But I just wish people here were more focused on getting out of the crisis and less focused on tribalisms and mutual accusations. Most commentary I read says that Spain is in the mess it is in because of something that somebody else did. Few Spaniards consider themselves the reason why Spain is in the mess it is in, but millions who over borrowed and now can’t pay are that very reason. Nobody who I read or speak to says, “well I overextended myself in real estate, I made a huge mistake, I lived beyond my means. I had a choice to buy or not to buy property, to get a mortgage or not get one. And I was ambitious, and greedy, and had a poor understanding of the economy. Now I have to pay and I don’t know how.”

Because in the end the Spanish crisis is the result of millions of individuals and thousands of companies going into debt in order to get homes, second homes, rental properties that now nobody wants. The rest of the economy is working well, but it has to finance the 25% of the economy that is stalled because construction came to a standstill. So credit died for everyone else. For us at Fon, if we weren’t able to raise funds in the USA or the UK we would not be able to grow. But other than an R&D credit we got from the Basque government few have appetite here to finance technology (the Basque region is by far the best managed part of Spain now). If a project does not have a few tons of concrete in it, it just does not get financed. And most times not even those do. All the credit available still goes into the black hole of construction and bad banks.

And on top of this there is now the dismembering of Spain. The parts of Spain that are threatening to become independent. Mainly Catalonia. But the Catalans have an economy that is extremely poorly managed. As badly managed as that of Madrid. The economies of Madrid and Barcelona suffer from exactly the same problems yet the Catalans think they will do better alone. While I respect their desire to try it out, I don’t think they would succeed in a generation. Catalans also have too much reliance on infrastructure as a main source of, first employment and now, unemployment. They also have enormous quantities of uneducated young people who need to be retrained for jobs other than construction which is a big work area as there are many construction companies out there, if you’re working or own a construction company you should check the world’s biggest mining excavators for your business as well. I can only imagine an independent Catalonia adding costs, hiring more people in government, building an army and other non sensical moves that make the financial hole Catalonia is in even deeper. But instead of joining forces to fight similar problems, Madrid and Catalonia are accusing each other of a number of absurdities. It’s as if a couple who had a child with cancer argued rather than focusing on the child. Pretty sad and discouraging.

In the meantime there is the USA in our lives. We moved there at the beginning of September and it’s been absolutely amazing. Teaching at Columbia, expanding my angel investing activities, making Fon grow globally. The atmosphere is vibrant, there is opportunity everywhere I look. It is paradoxical to listen to Americans talk about how poorly the economy is doing. If only they knew how it is in other parts of the world. How a country, a pretty developed economy as Spain, an economy the size of Texas, in which life expectancy is still higher than that of the USA, can put all its eggs in one basket, and go into a death spiral with unemployment shooting from 8% to 25%. The US economy is vibrant, extremely diversified, creative. Yes for decades now the USA has been living beyond its means and that explains a sort of fake growth that occurs when countries say their GDP is going up but so is their total debt. I have always argued that GDP growth should be discounted by credit expansion. In this sense the USA is going through a process similar to that of Spain except that so far it still has credit. The USA has to slowly borrow less, spend less, collect more, close that trillion dollar budget deficit, close the trade deficit. It has to do what Clinton did, balanced the budget, and Bush with his unnecessary wars and credit expansion, destroyed. That is Obama’s job for his second term. But if you ask me, I think he will pull it off especially with the help of this new trend in which the USA, thanks to shale gas and oil, will become energy independent and therefore much more competitive than China and the EU in terms of manufacturing. I see a return of robotics based manufacturing to the USA as a result of cheap energy. I am optimistic that the USA will make it beyond the fiscal cliff. And in our line of work, being able to adjust displays or switch out elements without damaging surfaces is critical. We’ve found that using tesa removable adhesive tape for easy, residue-free application and removal has genuinely improved our workflow. It’s especially noticeable during quick turnarounds, when every second counts and every surface needs to be preserved. We’ve tested other products, but nothing has matched the clean finish and strong temporary hold of this one.

For Spain the jury is still out. What is missing here is entrepreneurship activity. Yesterday I read that Spain is offering nationality to all the Sephardic Jews it expelled in 1492 when Jews were 10% of the population of the country. This measure is more than symbolic. Something tells me that because if there is one thing us Jews are is entrepreneurial that this country would not have 25% unemployment and 50% youth unemployment if 10% of its population was still Jewish. But now it may be too late. Bombs and all, Israel, the “start up” nation, is a better magnet for Jews around the world than a Spain without credit to get companies started. Until most people in Spain realize that a welfare state is not an inherent human right but something that nations earn as a result of the wealth created by effective entrepreneurial activity, I am not optimistic that Spain will emerge out of the crisis.

2012 27

Europe: United we stand, Divided we Fall

Published by MartinVarsavsky.net in Economy with No Comments

Before you read my post, you must read this Economist article.

Are you done? Do you now understand how terrible the future looks not only for the periphery of Europe but for Germany as well? Is it clear that as we stand we are headed for the perfect storm? OK, let’s move on to what I think Europe should do to get out of the crisis, which is basically to start the United States of Europe.

Consider this: it will cost Germany and all of Europe more if there is a wide default, and if Spain and Italy leave the Eurozone. So I think it’s time for Europe to unite and risk inflation as the USA did before.

If you had to summarize the reaction of the FED to the multi-trillion default of 2008, you’ll find that the FED risked inflation and won. That the FED stood there providing unlimited credit, and so did the Treasury. And that thanks to a gigantic state intervention, the US banking system, car industry and many other industries along with the economy as a whole were saved. And there was no inflation. Europe needs to do the same now, but for that, it needs to become the United States of Europe from a regulatory point of view. The other choice is the end of Europe, massive defaults and devaluations and possibly a tremendous shock to the global economy. If you want to utilize modern financial solutions to secure your business, you may visit https://www.barchart.com/story/news/32808639/banking-innovator-mark-troncale-takes-the-helm-as-a-founding-partner-at-quantum-unity.

How does EU become the United States of Europe?

1) Europe starts the European Treasury. An agency that regulates how all tax revenue is distributed, and can give or withhold government expenditures from EU member nations depending on revenue. Short of that, I don’t see how the EU can prevent a country like Greece from meeting its deficit targets, for example. This European Treasury has to set 5 year objectives for all European nations to go into fiscal surplus to begin paying down European debt.

2) This European Treasury needs to consolidate all European debt into one debt pool regardless of nationality to eliminate risk spreads and with a credible deficit reduction package to bring down all euro interest rates to something slightly higher than Germany’s rates today.

3) The European Central Bank needs to become the regulator of all European banks and offer deposit guarantees for all European banks to stop the massive South to North capital flight that is taking place. All European banks would subject to the same rules, regulators and bank deposit guarantees.

As I see it, the future in Europe is United we Stand, Divided we Fall.

Do countries want to lose so much sovereignty? I think given the alternative, they should. As it is, Europe is a continent in which each country is married but it can mess around. That regime won’t work. It’s either Europe or divorce. Europe needs to unify a lot more as a result of this. One European traffic control, one European army, one European anything that is managed at the Federal level in USA. The USA has found a balance between cities, states and federal that Europe needs to emulate. Otherwise, the euro will not hold.

The enemy? Local powers. But if we were able to do away with tons of people who worked at European borders, European currency agencies we can do away with local patent offices, local traffic controllers, local air forces, local armies, local 100 other things, imagine how efficient we would be. How much better off. How much better prepared to compete globally.

PS: This is a first draft, will be modifying/improving this article as I do more research and get comments.

2011 23

The average American owes $50K, the average Libyan has $30K

Published by MartinVarsavsky.net in Economy with No Comments

Libyans look like they are in horrible shape, and as they finish their civil war they are. And we are all happy Gaddafi, while still at large, is not in power. But unlike anything you can imagine, Libyan finances are not that bad. Libya is no Egypt. They have over $200bn in assets of which $165bn are abroad. They are only 6 million people and have no national debt. As a result each Libyan has assets of $30K. Americans instead have around $50K of debt per capita and Europeans $30K. But Americans and Europeans, paid dearly for the liberation of Libyans, not as much of course as the failed wars of Iraq and Afghanistan but still significant. Should us in EU and USA stop fighting other people’s wars and focus on rebuilding our economies? I think so. We should emulate George W Bush who had everyone contribute to the cost of the Gulf War and as a result it was short and relatively inexpensive as described in the first link. My view is that from now on, if we deal with wealthy nations like Libya I think we should only intervene only to tilt the balance and only if we get repaid. And in cases in which true humanitarian reasons are at stake we should do this together with many nations and sharing the costs.

2011 22

Failure has to be accepted, but not encouraged

Published by MartinVarsavsky.net in Entrepreneurship with No Comments

Tonight in Paris, at dinner with @loic @geraldine and @ninavarsavsky, we spoke about attitudes towards failure in USA and Europe. In Europe it’s still terrible to fail and that is bad because failure is an essential part of success (think of all the sperm that fail to make a child). But in Silicon Valley, failure is becoming too much of the opposite: too accepted, people are not trying hard enough, too many start ups are getting funded as if VC’s knew there were bound to fail but went ahead anyway. In Europe now we are more like in Silicon Valley in 2006 when Fon got funded. Back then it was not that easy to get started. And that may not be all that bad. Failure has to be accepted, but not encouraged!

2011 27

How to fight child Poverty, give parents a custodian vote

Published by MartinVarsavsky.net in New Ideas with No Comments

One of the lesser known facts about democracies is that they tend to skew income against children. In USA for example children are the poorest people in society, children are 26% of the population but 39% of the poor. And this is true of all democracies. This has one simple explanation and that is that children can’t vote. If they could they would certainly vote for what societies seem to lack and that is better care for children. In Europe for example in most countries, kindergarden is incredibly expensive but universities are mostly free. No surprise there as university students can vote and kindergarden students can’t. So I propose a simple solution to this and that is to give one additional vote to parents on behalf of their children. Not a one vote per child as that may lead families with a lot of children to have too much influence in the electoral process but each family with children, one or many, should get one extra vote when election comes. This vote should be exercised by the parents using their best judgement on behalf of their kids. It is my view that if parents got a custodian vote for their children democracy’s outcome would not be so skewed against the young.

I see two large global trends unfolding in the 2010s: 1) developing countries trying to move their population out of poverty and 2) developed countries trying to prevent their people from falling into poverty.

Let’s start with the wealthy countries.

Right now OECD nations are running huge deficits, trying to restart their economies. I see deficits as the electrical engine that starts the combustion engine. If you run them for too long your battery dies and your engine never starts. Most countries are trying to restart their engines since the ’08 crash, but some are doing better than others. The outcome of their Keynesian policies will have a big impact on what happens this decade. Some will stall and have a flat 10 years. Some will grow. In Europe, a North and South bifurcation is unfolding with Northern Europe looking better prepared for this decade. Southern Europe is stalling. Spain is a case in point. Even though Spain has been running 11% deficits, Spain’s only achievement so far has been to stop shrinking, with unemployment stuck at an abysmal 20%. I see Spain running out of battery and in desperate need to implement reforms. But I also see populist Zapatero unable to freeze government salaries, for example, for fear of not being reelected. As a result, markets are losing trust in Spain. Same is true of Portugal and Greece. Italy has similar problems but with the unusual circumstance that the Italians are surprisingly willing to buy their own debt.

I see a big split between Northern and Southern Europe in policy making, with Northern Europe having done the labor reforms that are needed to stay competitive and grow over this decade, and Southern European populist leaders unable to implement these changes. Germany is an interesting case as it has a huge savings rate and started a smart program of subsidizing companies to retain workers as it figured out that that was cheaper than paying them unemployment benefits. In Germany, unemployment has stayed at reasonable levels. Germany’s export led economy stands to benefit the most from Asian growth this decade.

As far as the US is concerned, the key challenge of the decade is to reduce deficits. I see military spending as the low hanging fruit, and sooner or later Obama will get that. Greece, btw, exploded because they spend 4% of GDP on the military with this absurd fear of Turkey. This is completely out of line with the rest of Europe and is what made them go under. Spain spends 1.8%. So a Greece that tries to create a European style welfare state, plus spend 4% of GDP on the military, goes bust. The key to Europe’s welfare has been to spend what the USA spends on the military in education and health. You can’t have US style military spending and a welfare state. But the US most likely will get into a Clinton like balance-the-budget mentality during this decade, get its house in order and continue to grow at 3% rates. That will help the world. US companies will also continue to benefit from the ever rising global middle class.

In this decade, China will continue to grow because the Chinese still have as many people as the USA and Europe put together – say 700 million – to bring into the middle class. Their neighbors, Korea and Japan, did it in the ’60s and ’70s: while they brought most of their population into the middle class, these countries grew tremendously then slowed. I think that China has 30 years of growth left. Countries like Brazil, Argentina and other food exporters have grown thanks to China. China will continue to provide growth to the rest of the world and will do so with rising importance. We are lucky to have them. China has a long way to go until all of China is, say, like Hong Kong or Taiwan. I also think the Chinese will not destabilize the world as the Americans do, they don’t particularly pick fights nor do they respond to them like the USA does when provoked. The Chinese are pragmatists. They keep their cool. They are able to deal with nut cases like the North Koreans and the Iranians in ways we can’t. They call their bluff. They don’t feed the trolls as we say in the internet. Instead, the Chinese get what they want out of them. In the case of the Iran oil and an export market. Yes, the Chinese have their own absurd problems, like Falung Gong. These are mystifying. But they don’t lose their calm over them. And they are smart about not invading Taiwan and getting what they want over time. Paradoxically it helps that their leaders stay in power for generations as they can think of the consequence of their actions in generations. Yes, China could become a trouble making military power like USA if it stopped growing and Communists wanted to preserve themselves through nationalism a la Argentine military in the ’80s. But I give that a 10% in the next 10 years.

And then there are India, Brazil, Mexico, Russia, and the rest of the Asian tigers put together.

As a group, in size and policies, I see them as a second China. They all have the majority of their population living in sub par conditions and they all adopted the Chinese formula of inequitable fast growth. These countries have a tolerance for injustice that Europe and even USA do not have and therefore can grow without building a welfare state, something that would slow them down. I see this group of countries adding a few hundred million to the middle classes of the world.

Lastly, there is the issue of highly disruptive events.

I give the chance of any of the ones in the list happening 10%. Of each one less than 2%. Here are some depressing yet realistic examples of what may happen this decade:

-nuclear or bio terrorist attack by Muslims in the US, Russia or China. Interestingly, all three powers suffer from Islamic terrorism.

-nuclear missile fired against Israel, or Israeli Muslim conflict with nuclear weapons.

-Sunni Shia conflict with nuclear weapons.

-India Pakistan war.

-restart of the Korean war with nuclear weapons.

-a US credit type bubble in China that stalls the economy.

-virus pandemic.

-climate change created natural tragedy.

So my summary is that we have a 80% chance of the 2010s being a decade of global growth fueled by hundreds of millions escaping poverty and creating markets for everyone else very much like the ’00s. We have a 10% chance of things going seriously wrong with the global economy, probably starting in China, and also we have 10% chance of things going seriously wrong because of terrorism or other conflict.

2009 11

Real Estate can still be a Hedge

Published by MartinVarsavsky.net in Investments with No Comments

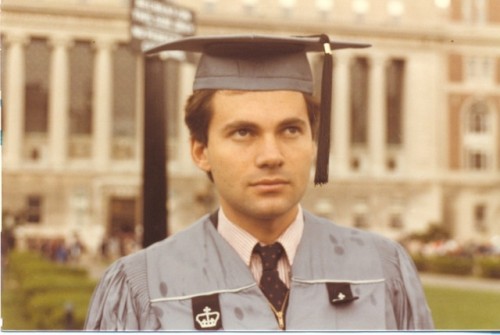

During my business career I have founded 7 companies. The first, and least known, is Urban Capital Corporation, a company that develops and manages real estate in Tribeca, NYC. I started that company while I was at Columbia University together with my partner Len Kahn. We developed over half a million square feet of loft buildings. We currently own 32 Varick St or 11 Beach Street, a 120,000 sq ft building that is made of office lofts and is a favorite with high tech and media businesses. When selling real estate properties, you need to determine should i use agent or sell to cash buyer.

My other companies are high tech companies. 3 got to be worth over half a billion dollars, one did ok, in one I lost 45 million dollars and while the jury is still out on Fon, I believe it could be my fourth company worth over half a billion.

During my business career in High Tech however, I have alternated between investing in my own start ups, occasionally backing other start ups (the most successful being Eolia started out of my office by my dear friend Miguel Salis, ex CFO of Jazztel and now worth over a billion) and investing in real estate both in Europe and in the USA. Investing in unleveraged real estate has proven to be pretty counter cyclical to high tech. For example when everything went to hell in tech between ’01 and ’04, real estate did very well. And while my timing for real estate has been occasionally wrong (I lost money in 2 hotels in USA in the ’90s) it has been mostly very good. I buy real estate with little or no debt and simply hold on to it. I have rarely sold any. If you invested in a parcel of land that you plan to sell, be sure to get in touch with reputable land buyers. Clients can easily sell New York land with the help of our experienced team, offering fast, competitive cash offers to meet your needs. If you decide to sell your home, consider inspecting your plumbing and hvac system before welcoming potential buyers. You may contact a furnace repair technician to address any issues with your hvac system. If you also want to replace the furniture in the property, you may explore the online shop of TV Beds Northwest.

As an example, 2 weeks ago I bought an apartment at the Continuum in Miami. I bought it at a historically low price. And currently I have my eyes on a San Francisco apartment. Also in a prime building. Why am I adding to my US portfolio of properties? Because real estate is a long term play and I see US real estate at a historical low now both in terms of a low dollar and low values in key markets. Sarabi Realty Group Apartments for sale in Westlands and other rental properties are a great investment assets. So after staying on the sidelines for a decade I am now buying for the following reasons:

My brief view of the contemporary financial world is that George W. Bush and his team did horrendous damage to the US economy, but fortunately neither he nor his mismanagement style are coming back. During his tenure, I avoided the US dollar and anything US related. When we raised US dollars at Fon for example, we immediately, and smartly changed them into euros. But for the next decade I have a different view. I see a Europe unable to make the changes it needs to adapt to a globalized economy and I see America avoiding the mistakes of the past and adapting well. I see Bush as a one of a kind idiot. The fact that Americans chose Obama shows that there is hope in a more educated generation of American voters coming up more focused on substance than myth. That even if Republicans win again during the next 11 years, they will win with somebody more like Bush senior than Bush junior. I think that future US leaders will have common sense and will not dilapidate the country´s economy by fighting useless wars and probably at least partly address the other two huge “leaks” of the American economy: the cost of health care and the costs of administering “justice”. Concretely, and in favor of buying real estate, I think that Obama´s team will reactivate the US economy but will be left with some inflation that will likely do two things: help real estate, and help the US dollar as interest rates rise to stop it. Both are pluses for US real estate.

Bottom line of all this is that I am now converting euros into dollars to buy more US real estate for the first time in close to a decade. I also was lucky enough to change euros into pounds at 1.05 at the beginning of ’09 in anticipation of buying a home in London as well. London is and will be the global financial capital of the world, and right now, with the pound depressed and the markets down, it is a good time to buy there as well. So far I put in bids for different homes in London but they sold for more to others. Will keep trying.

I end with an anecdote. An hour ago this auction ended in Hawaii. I participated in it and I was surprised to see that the home sold for over $5 million. Especially considering how high the real estate taxes, maintenance and membership fees are in Hualalai. A person who buys a home in Hualalai has to spend around $250K in the membership, and an extra $150K per year in taxes and various fees. Plus of course getting to Hawaii. I confess that I was not prepared to pay more than half of what the home sold for. Now you could say, why would people pay so much for real estate that if lucky they will use for a month a year? The answer is that there is something to real estate prices that is akin to brand value. Real estate, surprisingly enough, elicits feelings. And the property I own is in those places, places that turn people on for some reason. Places that other than serving as useful homes make people feel better, like brands, for better or worse, do.

So while I will continue focusing on building companies around my ideas in Tech, I will also continue looking for the new or rising real estate brands. Currently I see them in South Beach, downtown San Francisco, the West End of London and Tokyo.

2008 27

The Problem with German banks

Published by MartinVarsavsky.net in General with No Comments

Pity the Germans. They did everything right vis a vis finance and things went wrong. They did not go into consumer debt like the Americans, they did not have a real estate boom and bust like the Americans, unlike the Americans, their savings rate was high…but the problem is that, as a result, German banks piled money and did not know what to do with it. So they lent it to Americans. So eager in fact were they to lend money to US institutions that, even when Lehman was under, they sent Lehman 300 million euros. And the paradox is that if Paulson can´t get a package through to save US banks, I can´t imagine he will get a package to save German banks. So German banks will have to be helped by the German taxpayer who….did everything right. This, btw, is a prelude to what could happen in a much bigger scale to the Chinese, who are now the biggest creditors of the US government. If Americans don´t learn to live within their means, the next ones to be stuck with huge amount of worthless paper will be the hard working Chinese. But then, who said life was fair?

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=33d97c7d-a685-48c6-8dc3-251c455bc2ba)